You Built a Creator Economy Agency. What’s Your Exit Strategy?

Key Takeaways from the Evros Group x Net Influencer Webinar on M&A for Creator Economy Founders

The creator economy has entered its next chapter. Agencies that built their reputations on cultural fluency, influencer relationships, and creative agility are now commanding serious attention from buyers, everyone from holding companies to private equity firms to entertainment conglomerates are tuned in and paying attention.

In a recent webinar, “You Built a Creator Economy Agency. What’s Your Exit Strategy?”, CEO Andreas Roell joined Evan Horowitz, Co-Founder & CEO of Movers+Shakers, and Nii Ahene of Net Influencer to demystify the M&A process for agency founders. The conversation broke down what’s driving deals today, how to prepare your business for an eventual sale, and the biggest misconceptions founders have about exits. Here are five takeaways from the session.

1. The Creator Economy M&A Landscape Is Hot, But Maturity Matters

“The reality is, you’re at the right place at the right time,” said Andreas Roell, CEO of Evros Group. “Buyers want to own more of the intersection between culture, community, and entertainment.”

Recent transactions like Publicis’ $500M acquisition of Influential, Accenture Song’s purchase of Superdigital, and Stagwell’s acquisition of Movers+Shakers are signaling a second wave of M&A activity.

But opportunity alone isn’t enough. Roell emphasized the difference between momentum and maturity. Structural readiness: clean legal agreements, financial discipline, scalable operations, and so on, can dramatically influence valuation and even make or break a deal. “The higher your ambition for an outcome,” he noted, “the more robust and professional you have to build yourself around it.”

2. Exits Are About Optionality, Not Retirement

As moderator Nii Ahene framed it, most founders think of M&A like a finish line. In reality, it’s about optionality. “This isn’t about walking away,” Roell agreed. “It’s about understanding your choices — bringing in growth capital, finding a strategic partner, or even staying independent — and building toward those options intentionally.”

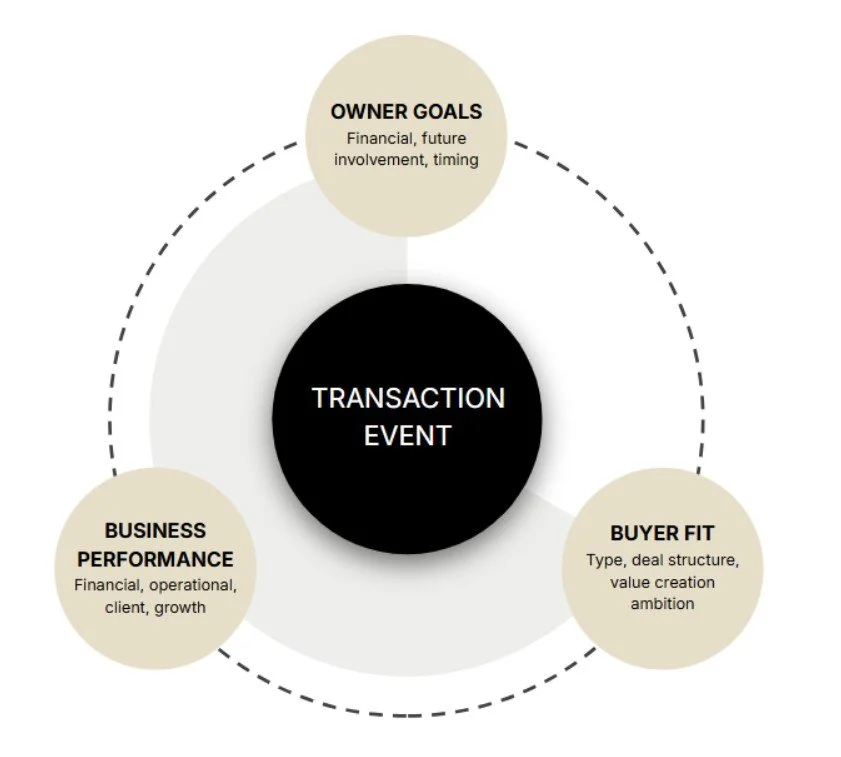

The Evros team’s approach centers on intentionality: defining personal goals early, mapping the business decisions that get you there, and aligning those with the right type of buyer. “We start every conversation with the founder’s objectives,” Roell said. “Financial outcomes, team legacy, future involvement: those shape the kind of transaction you should pursue.”

3. Founder Lessons: Run Your Business Like You’ll Sell Tomorrow (Even If You Won’t)

For Evan Horowitz, whose agency Movers+Shakers was recently acquired by Stagwell, preparing for M&A started as a crash course in business discipline.

“When we began talking to advisors, they asked questions we didn’t have great answers for,” he said. “But those were the same questions that make you a better operator: Are your margins healthy? Is your leadership team scalable? Are your contracts clean?”

He credits Evros’s advisory approach with helping them operate smarter long before a deal was on the table. “Our M&A advisors actually became our business coaches. Ninety-five percent of what buyers look for is just good business hygiene,” Horowitz said. “Running your company like it could be sold tomorrow only makes it stronger today.”

4. The New Generation of Buyers

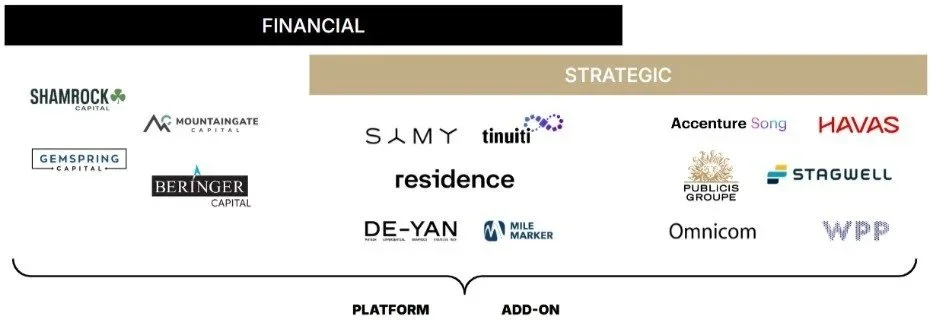

Evros Group’s analysis shows a wider variety of acquirers than ever before — private equity, entertainment groups, and social-first holding companies are all moving into the space.

“This isn’t just about selling to the big ad networks anymore,” said Roell. “Private equity wants scalable platforms. Entertainment companies want creator-led content pipelines. Everyone’s trying to buy culture.”

Buyers are especially interested in tech-enabled service models, where proprietary data, talent relationships, or creator platforms create defensible value. Roell pointed to deals where in-house content capabilities and data infrastructure drove higher multiples, “because they signal long-term scalability, not just short-term revenue.”

5. Start Early — and Surround Yourself with Expertise

If there was one universal takeaway, it was this: Don’t wait until you’re ready to sell to start thinking like a seller.

“The earlier you prepare, the more optionality you have,” Roell said. “Even if you’re five years away, you can start aligning your structure and story now.”

That includes surrounding yourself with the right advisors, legal, accounting, and M&A experts, who understand the nuances of the marketing and creator economy. As Horowitz put it, “I used to think banker fees were outrageous. Now I realize good advisors more than pay for themselves — they increase valuation, structure smarter deals, and save you from mistakes that cost far more.”

Final Takeaway: Intentional Growth Creates Better Exits

Whether you’re planning a sale next year or just building toward long-term sustainability, intentionality is the through-line.

“Hope is not a strategy,” Roell reminded founders. “If you want a successful exit, start now: define your goals, understand your buyer landscape, and build the kind of business that can stand up to scrutiny.”

Interested in diving in deeper? You can watch the full conversation here: